What is the difference between a reverse mortgage and a home equity loan? Find out more about which option is best for you.

For homeowners looking to access their hard-earned home equity, there are a few ways to do so –– with the most common being home equity loans (or home equity line of credit) or reverse mortgages. And while each of these tools may accomplish a similar end goal, each possesses its own set of nuances which make it the right choice for some homeowners and the wrong one for others. At the end of the day, the winner of the great reverse mortgage vs. home equity loan debate will come down to your specific situation and your desired outcome. After exploring these two options, you may decide that one of the other alternatives to reverse mortgages is a better fit for you.

Learn more about the differences between a reverse mortgage loan and home equity loan, and decide for yourself which pathway might be right for you.

As homeowners continue to make payments on their home loan, they steadily accrue more equity. And as this percentage of ownership grows relative to the value of the home, homeowners can begin to leverage their equity into repair projects, better interest rates, and even dream vacations. Loan products like reverse mortgages, home equity loans, and home equity lines of credit (HELOCs) provide pathways for homeowners to access this equity and put it to work toward any number of goals.

At first glance, a home equity loan and a reverse mortgage appear to be one and the same. However, upon peeling back some of the layers of these loan products, you begin to see exactly how different they truly are — both from each other and from a traditional mortgage. When directly comparing a reverse mortgage vs. home equity loan, the biggest difference you’ll see is that reverse mortgages were designed for an older homeowner with a significant amount of home equity. In contrast, a home equity loan is available for just about every qualifying homeowner with as little as 20% home equity to their name.

Ultimately, in the case of both a reverse mortgage and a home equity loan, homeowners are raising their home –– likely the largest asset many Americans possess –– as collateral. And while the rewards of both can be vast, for some, the risks of each may simply be too large. With that said, homeowners opting for a reverse mortgage stand to lose more than those considering a home equity loan or HELOC, making these the safer option for some.

It’s fair to say that reverse mortgages have developed a bit of a negative reputation in the last two decades, but we should note that these products aren’t inherently bad. But to older homeowners who hear what sounds like “free money” and disregard the catch(es), it can be easy for some to get more than they seemingly bargained for. When exploring the potential downsides of this option, it’s key to understand that not every reverse mortgage operates the same. Asking the right questions — like “What are the three types of reverse mortgages?” — can help ensure you’re choosing the best option for your unique situation.

Like with any financial product, reverse mortgage agreements come with their fair share of fine print to navigate. In many cases, this fine print can “hide” unexpected fees, which chip away at home equity at a far faster pace than borrowers are expecting. Reverse mortgages, like other home loans, require sizeable up-front costs, which can catch many homeowners by surprise. Ultimately, loan products are exactly that –– products –– and the unfortunate truth is that unscrupulous salespeople may take advantage of senior borrowers, blurring the truth, making false promises, and creating a resulting air of confusion all for the sake of a deal. If you’re a homeowner exploring reverse mortgage options, consult your lawyer or a trusted financial advisor when reviewing any official terms.

Perhaps the biggest downside of a proprietary reverse mortgage is also one of its biggest perks. Loan repayment, as we’ll discuss in greater detail below, can be more lenient in a reverse mortgage than both a home equity loan and HELOC, but certain stipulations can also quickly cause things to go south. Per the terms of most reverse mortgages, homeowners who vacate their homes or fall behind on property tax payments may be immediately responsible for repayment. In the event that an older homeowner has a fall and spends a number of months in out-of-home care, they could return to find that their home is gone and the entirety of the loan amount is due, quite literally adding insult to injury.

Once again, reverse mortgages are not dangerous by design. But given the demographic for this loan product, it is crucial that homeowners know exactly what lies in store (and what they could stand to lose) before pursuing this option.

Who does a reverse mortgage benefit most? In short: The 62+ homeowner who has done all their research, understands the risks, and has determined that the surge in monthly income will not impact their social security or Medicaid eligibility. But there are also a few specific circumstances where older homeowners might consider a proprietary reverse mortgage over the other equity-unlocking options discussed here.

A reverse mortgage might be best for the homeowner who:

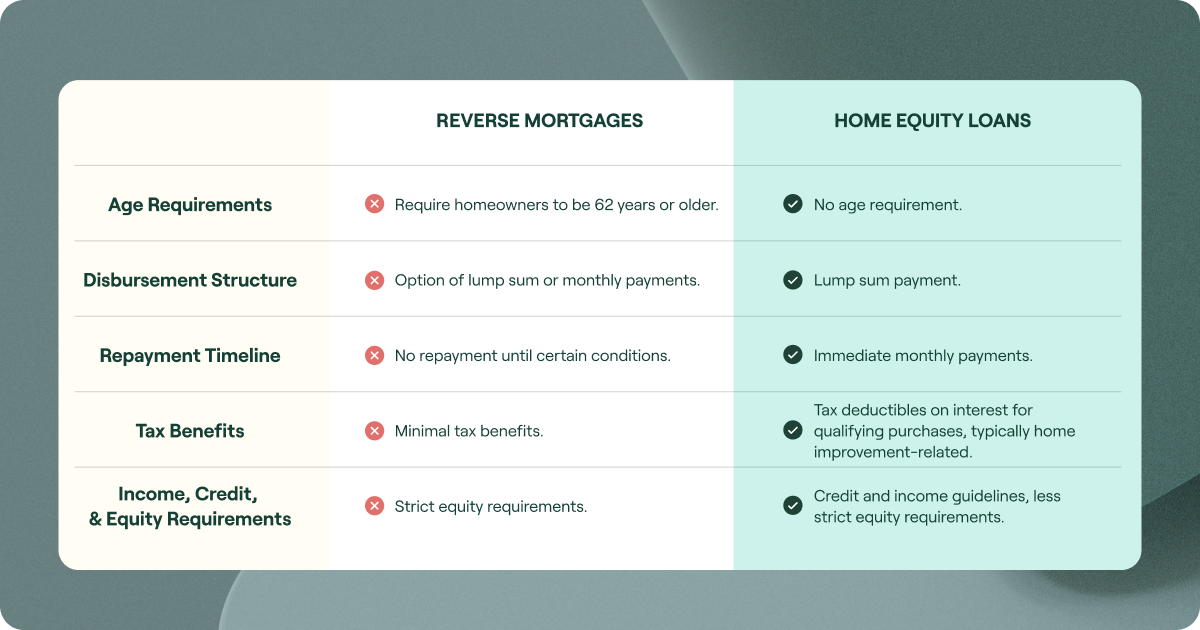

Determining which of these options is for you will start with a deep understanding of the similarities and differences between these loan products. Below, we have broken down five of the key differentiators between home equity loans, home equity lines of credit and reverse mortgages.

Out of a home equity loan, a home equity line of credit, and a reverse mortgage, the reverse mortgage is the only pathway to home equity that comes with an age requirement. In order to participate in a reverse mortgage and access home equity, homeowners must be 62 years or older. This requirement is part of what has historically made reverse mortgages more popular among seniors and older homeowners. The money paid out through a reverse mortgage (either in a lump sum or through monthly payments) should not affect the receipt of benefits like Medicaid and social security. With that said, be sure to determine whether this income will affect your eligibility before you go all in on a reverse mortgage.

The method and frequency in which funds are distributed is one of the most significant differences between home equity loans and reverse mortgages. In the case of home equity loans, equity is paid out in a single lump sum. A reverse mortgage, on the other hand, brings added flexibility. Homeowners who qualify for a reverse mortgage have the option of receiving a monthly mortgage payment or a lump sum, allowing these homeowners to decide how this income can be the most helpful.

A home equity line of credit departs from both of these mortgage loan products in that, upon approval, homeowners are given a window of time to draw from their home equity. During this period, borrowers can draw as much as they need, and as often as they want, within the confines of their pre-approved limit.

Immediately upon receiving a loan, whether through a reverse mortgage, home equity loan, or home equity line of credit, borrowers should begin thinking about repayment of the loan balance. Homeowners potentially have the largest repayment window under the guidelines of a reverse mortgage, as no repayment is owed until the borrower will no longer be living in the home or is unable to continue making property tax or homeowners insurance payments. Should the condition of the home deteriorate consistently, the repayment period may begin — or payment in full may be demanded.

Home equity loans and home equity lines of credit, on the other hand, are more structured in their repayment horizons. Shortly after receipt of a home equity loan, borrowers begin making monthly payments with a fixed interest rate and are on the road to repayment. With a home equity line of credit, however, standalone interest payments are made during the draw period, with principal payments beginning only after the draw period has closed. Should you explore this option, be sure not to let the full repayment period catch you by surprise, as your new monthly payments could be double or even triple what you’re used to paying.

As mentioned above, reverse mortgage recipients should be protected from having Medicaid and social security benefits impacted by this added monthly “income,” but this is the first and last tax benefit of this strategy. Homeowners who opt for a home equity loan or a HELOC, on the other hand, are a bit more tax-advantaged –– with available tax deductibles only on the interest paid for qualifying purchases. Generally, these purchases must be home improvement-oriented to qualify, with an emphasis on driving up property value and, therefore, further securing the loan.

In order to issue a loan, be it in the form of a reverse mortgage, home equity loan, or home equity line of credit, lenders will want to be sure that borrowers can make good on their end of the deal. For that reason, there are credit and income guidelines for each loan product, while only home equity loans and HELOCs have hard requirements. These requirements can vary, with a credit score above 680 generally being deemed sufficient as well as a fairly low debt-to-income ratio.

As for the equity requirements of these options, reverse mortgages are the most strict. Most reverse mortgage providers demand that borrowers own their home in its entirety or, at the very least, have the majority of the loan paid off. In contrast, home equity loans and home equity lines of credit are often available with as little as 20% home equity.

By now, you’ll have figured out that –– despite their similarities –– reverse mortgages, home equity loans, and home equity lines of credit each possess nuances that make them just right for some homeowners and all wrong for others. Before we leave you to decide if one of these paths toward tapping into home equity is right for you, we want to introduce another option that combines great elements of each: Truehold’s sell and stay transaction.

Through a sell and stay transaction, homeowners of all ages are able to sell their homes, instantly access their hard-earned home equity, and continue living in the familiar environment as a renter. In exchange for monthly rent payments, Truehold will handle property insurance, property tax, and essential repairs. You trade your existing mortgage for the simplicity of life as a renter in the home you love.

Unlike a reverse mortgage, you don’t run the risk of losing your home over one late payment. Unlike a home equity loan, you don’t have to worry about applying your entire vacation fund toward purchasing a new roof. And unlike a home equity line of credit, you won’t have to dread the end of the drawing window and the subsequent doubling of your monthly payment.

So far, we've shown hundreds of homeowners that reverse mortgages, home equity loans, and HELOCs aren't the only way — and that a sell and stay transaction might be a better way to access your home equity. From acting as retirement income to helping pay off student loans, the equity you gain back from this option can lead to countless possibilities that enhance your future. To learn more about Truehold's sell and stay transaction and see why more and more homeowners are unlocking home equity in new ways, request our free info kit.

Visit our resources library today for more information on Rent Back Agreements and Rent Back Agreement Risks.

Chat with a real person & get an offer for your home within 48 hours.

Call (314) 353-9757